Advertisement

In the current digital era, handling money matters frequently depends on the ease and availability offered by mobile apps. Mobile applications for credit cards have become important instruments for individuals who want to effectively control their credit cards online. These programs come with various perks allowing users not only to keep an eye on expenditures but also make transactions and receive rewards using just their smartphones. This article will look into different features, advantages, and leading players in the field of credit card mobile apps. The goal is to guide readers toward selecting the most suitable choice that caters to their financial management requirements.

Mobile applications for credit cards are like extra tools for managing a user's finances. They make it easy to interact with the credit card accounts. The majority of banks and credit card firms give their customers specific mobile apps that help them to reach account details and features without difficulty. These apps often have an understandable user interface which improves the way users feel by making navigating through different functions, such as looking at balances, previous transactions, and payment history simple. Moreover, numerous applications provide a customized understanding of. Expenditure patterns, empowering users to make knowledgeable monetary choices.

These apps have the main purpose of enabling users to manage their finances and assisting them in monitoring their expenses immediately. Users can get immediate warnings about due dates for payments, the latest transactions, and special deals with push notifications, making sure they never overlook an important update related to their credit card accounts.

A high-quality mobile application for. Credit cards usually include multiple important features to improve the experience of users. The most useful feature is tracking transactions as they happen. Customers can see their latest buys and classify them based on how they spend money, helping in making budgets and planning finances. Additionally, numerous applications give users the ability to establish budgets or notifications for particular categories; this promotes improved regulation of financial behaviors.

A crucial characteristic is the capacity to execute payments straight from the application. Users have the option to establish single-time payments or arrange for recurring ones, this ensures that bills are settled promptly which can aid in preventing late charges and potentially harmful effects on credit ratings. Additionally, managing rewards and cash-back deals is an increasingly admired feature among individuals who use credit cards. Several applications offer a simple method for customers to claim rewards points or cashback directly in the app, making the procedure more efficient and improving customer happiness.

Additionally, security elements are a vital part of credit card mobile applications. Users must seek apps that provide a multiple-step verification process, biometric sign-in choices like fingerprint or face identification, and the quick option to halt or activate cards if suspicious actions are thought about. These attributes lead to a safe banking experience that offers users comfort while dealing with their monetary affairs.

When you think about which credit card mobile app to choose, it is very important to check some things that may affect how well the user can interact with the app. Firstly, see if your credit card provider works properly with the app. Many big banks and companies that issue credit cards have their apps created for them; However, you must be sure your particular card will work to effectively use all functions of these apps.

Reviews and scores given by users can give an understanding of how well the app works and its trustworthiness. An app with good ratings usually means it is easy to use, and has many useful features. Besides that, researching customer help provided in the app is also very important. If problems occur, it can be very helpful to have quick access to assistance. This could greatly speed up the resolution of any issues that may arise.

Another thing to think about is how the app works in general. Some apps provide extra capabilities like helping you budget or combining with other money management programs. These abilities can assist in creating a more complete strategy for controlling your finances, enabling people to monitor their total spending habits efficiently.

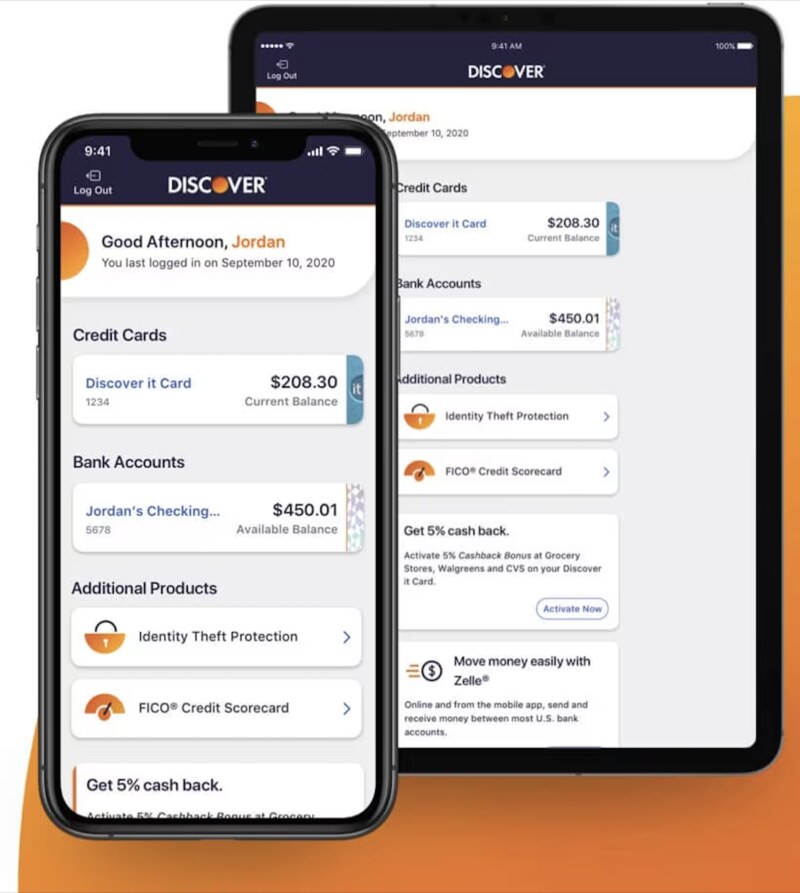

Many mobile applications for credit cards are accessible, with a few gaining good praise due to their functions and user-friendly nature. For example, apps such as Chase Mobile, Discover Mobile, and American Express have proved themselves as trustworthy choices. Each provides special features that fulfill varied demands the of users. Chase Mobile presents broad banking options together with the management of credit cards which makes it the perfect selection for clients of this bank.

Conversely, Discover Mobile highlights client rewards and cash refunds, it provides a simple-to-use interface for monitoring points and using them. American Express is famous for its broad rewards scheme and characteristics that assist users in increasing their advantages while ensuring safe access to account information. Each of these applications possesses unique strengths, serving different financial management styles and preferences.

For the best use of a credit card mobile app, people must actively use all features. By frequently checking transaction history, they can see how they spend money and make changes if required. If users set reminders for when payment is due, this helps them to pay on time and safeguards their credit ratings.

Using money planning tools or connecting the app with more general financial management software can give a complete picture of your financial status. Users also need to keep up-to-date about any new functions or updates provided by the app, because many creators constantly better their applications for improved user comfort and protection. Joining in special offers through the app can result in extra savings, particularly if users often use their credit cards when buying things.

To conclude, mobile applications for credit cards have changed how people handle their money. They offer tools that encourage good financial habits and responsibility. By knowing the main features and assessing the top choices available, users can choose an app that fits them best. These apps are useful resources in dealing with personal finance complexities whether it is keeping track of expenditures, paying, bills, or handling rewards points. By using the appropriate application, individuals can make substantial progress towards reaching their financial objectives and experience the comfort of present-day technology.

Advertisement

By Aldrich Acheson/Feb 28, 2025

By Elva Flynn/Feb 28, 2025

By Gabrielle Bennett /Mar 16, 2025

By Pamela Andrew/Feb 28, 2025

By Aldrich Acheson/Feb 28, 2025

By Gabrielle Bennett /Dec 10, 2024

By Kristina Cappetta/Mar 18, 2025

By Isabella Moss/Nov 09, 2024

By Isabella Moss/Nov 07, 2024

By Noa Ensign/Nov 07, 2024

By Sid Leonard/Apr 02, 2025

By Christin Shatzman/Dec 08, 2024