Advertisement

A guaranteed lifetime annuity is a finance product that suggests giving constant income for the rest of one person's life. This mechanism in finance holds special value for people who retire and want to make sure they have dependable money coming.. during their later years. The idea involves grouping funds from many investors together with assurance of payout to persons till lifetime, solving a major worry related to planning retirement: the danger of outliving the savings one has made earlier. This article is going to examine the functioning of guaranteed lifetime annuities, their advantages, and what people should consider if they plan on using them as part of their retirement planning.

A guaranteed lifetime annuity usually includes two steps: the gathering phase and the giving out phase. In the gathering stage, a person makes one large payment or several contributions to the annuity. This step lets an investment increase in value, either through interest earned or returns from investments made, based on which kind of annuity is chosen. When the person attains the age of retirement, they move into the distribution stage. At this point, the insurance firm starts to disburse a sure income for the rest of its life. This remittance is established before and it can give tranquility in mind that money will be there no matter how long one survives.

Besides these two main stages, it's crucial to understand some annuities provide adaptable choices connected with payment plans. For example, people can select monthly, quarterly, or yearly payments according to their financial necessities. This adaptable. It is useful in handling cash flow and lets retired persons match their annuity payouts with other income streams or particular costs like healthcare or mortgage expenses. Knowing how both stages work can give people the power to make knowledgeable choices that match their goals for retirement.

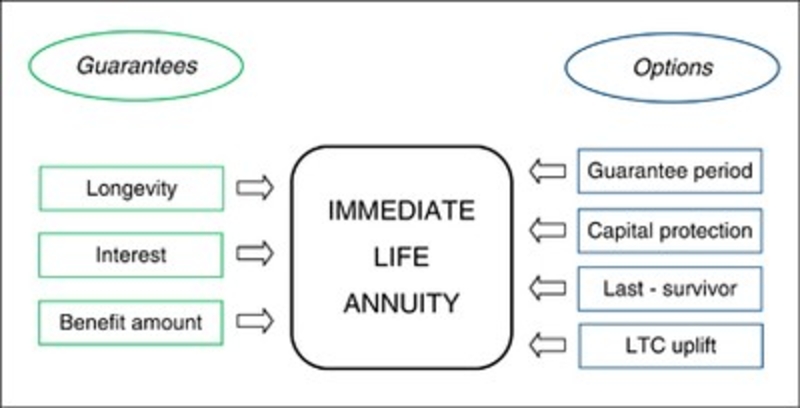

Various sorts of lifetime annuities are assured, each being suitable for different monetary aims and requirements. The most frequent categories are immediate and deferred annuities. An immediate annuity starts payouts soon after a large amount is given, this makes it perfect for those individuals who are close to retirement. On the other hand, a kind of annuity known as deferred lets people put in money and gain interest before they start to take out funds. This could be good for younger people saving up toward retirement. There are also choices like joint-life annuities that allow income flow for both partners until none is alive anymore. This might suit those worried about their spouse's financial well-being after they're gone.

In addition, people have the option to look into different versions like indexed annuities. These are attached to a certain stock market index and give a chance for possible growth but also offer minimum assured income. It is beneficial for people if they grasp the subtle differences among these various kinds because it will assist them in customizing their retirement plans according to their specific requirements. This ensures they pick a suitable product that fits well with their financial goals and ability to bear risk.

A main advantage of an assured lifelong annuity is the monetary stability it offers. It gives a stable flow of income for life, allowing retired individuals to better control their spending without fear about changes in the market or using up all their savings. This reliable money input can assist with crucial expenses such as accommodation, healthcare, and everyday living costs. Moreover, certain annuities provide extra benefits, like protection from inflation. This means the payouts can grow over time to match with increasing living expenses. It also improves financial security for retired people while they live through their older years.

Another big advantage is the mental tranquility you get knowing your earnings are certain, no matter how long you stay alive. This sureness can soften stress linked with financial arrangements in retirement years, letting people relish their later life without fear of unstable financial conditions. Also, a lot of annuities offer death benefits to receivers and make sure some part of the investment will be transferred to family members which aids in more secure familial financial management planning.

Before deciding on a guaranteed lifetime annuity, one must think critically about many things. The first important thing is checking personal financial needs and retirement targets. Knowing how much money you need and when the payments have to start will be beneficial in choosing a suitable kind of annuity. Another important detail to consider is the costs linked with the annuity. These can change a lot between different products. Certain annuities come with relinquishment charges and management costs which may impact total returns. Checking out the financial stability of the insurance company offering this annuity also matters, since its capability to fulfill upcoming commitments is key for long-term safety.

Furthermore, people must take into consideration their total investment plan and how an annuity works in this context. The fact that annuities are not easily convertible to cash signifies that once the money is invested, it might be difficult to use it during emergencies. It's important to grasp this point so as not to face financial pressure during unforeseen circumstances. It is a good idea to carefully check all rules and guidelines. This helps make sure that the chosen product matches your long-term money strategy and personal situation.

Including a lifetime annuity with surety in an extensive retirement plan may improve financial stability. Annuities can supplement other income streams like Social Security, pensions, or personal savings, this way creating diverse revenue collection. When making plans, people should think about how annuities coincide with their total asset distribution and risk acceptance level. For instance, people who have big investments in the stock market might discover that adding a secure income source from an annuity can reduce overall fluctuations in their portfolio. This protects them during times when the market is not performing well.

Also, putting annuities into a retirement plan promotes an even-handed way of managing finances. It gives people the chance to smartly distribute resources to make the most returns while also making sure there's a backup for living costs. Regular checks and changes in one's retirement strategy can help account for different aspects like lifestyle alterations, health situations, or shifts in financial markets. This ensures that the annuity keeps on satisfying your needs after you retire effectively.

A guaranteed lifetime annuity can become a precious part of planning for retirement, providing steady income flow and security in finances for life. It's necessary to know how these financial things work, the different types we have, and their good points and bad points to make well-informed decisions. By adding annuities into an all-encompassing plan for retirement, people can boost their stability financially and have a more relaxed mind during their years of retirement. Like any money-related choice, it is suggested to talk with a finance advisor. This makes sure that a lifetime annuity with guaranteed payments matches your total financial aims and situation.

Advertisement

By Jennifer Redmond/Mar 16, 2025

By Mason Garvey/Dec 10, 2024

By Alison Perry/Dec 04, 2024

By Noa Ensign/Nov 07, 2024

By Isabella Moss/Nov 09, 2024

By Elena Davis/Mar 16, 2025

By Aldrich Acheson/Feb 28, 2025

By Susan Kelly/Mar 17, 2025

By Celia Kreitner/Dec 08, 2024

By Celia Shatzman/Dec 04, 2024

By Isabella Moss/Nov 07, 2024

By Georgia Vincent/Dec 15, 2024