Advertisement

With the ongoing adoption of technology improvements in businesses, the transition to digital payment solutions has grown crucial. A highly useful method to improve financial transaction efficiency is using Automated Clearing House (ACH) payment processing. This system enables direct transfers between banks and lets firms as well as people send or receive money electronically, ultimately making payments smoother and more efficient. In this article, we are going to study the advantages of ACH payment processing, its operation process, and the diverse functionalities it provides for companies.

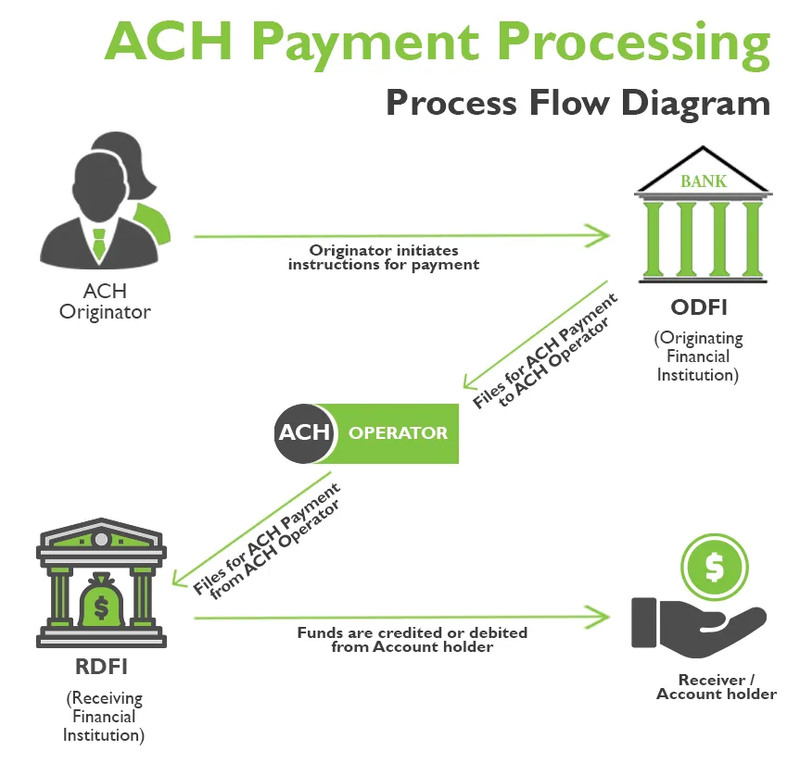

ACH payment processing functions via a network that links financial institutions together, enabling the electronic movement of money. This method was set up to make it more straightforward and faster to transfer funds between bank accounts without requiring physical checks. It covers multiple transaction categories such as direct deposits, payroll, payments to suppliers, and consumer transactions. The National Automated Clearing House Association (NACHA) controls the ACH network. This control confirms protection and obedience for each transaction. Businesses, by using ACH payments, can experience quick transaction times, cut down costs tied to old-fashioned payment ways, and better management of cash flow.

Besides these advantages, ACH payment processing ng caters to both credit and debit transactions. This widens its use for different types of payments. Companies can employ ACH for repeated payments which makes it perfect for subscription services or constant billing cycles. When you incorporate ACH into accounting software, this simplifies financial governance by automating the matching process and lowering the possibility of mistakes made by people. Such enhancements contribute to improved financial oversight and accuracy in accounting practices.

One big plus point of ACH payment processing is it helps save money. Common ways of payment like checks and credit cards usually charge high processing costs. But, with ACH transactions, these charges are typically less which can result in major cost savings for businesses as time passes. Furthermore, ACH payments are remarkably safe. This method uses a range of security precautions to defend delicate financial information during transactions, thus lowering the chance of deceit and illicit access. By automating payment procedures, ACH also increases effectiveness, cutting down time used on manual entries and balancing accounts. Consequently, companies can dedicate additional resources to strategic plans instead of management duties.

One significant benefit of ACH payments is how they affect the environment. By getting rid of paper checks, waste is diminished which supports more green business methods. Moreover, businesses can get advantages from enhanced money flow control due to the regular pattern of ACH transactions. With payment and collection schedules being set, companies can plan their finances in a better way and maintain liquidity. This consistent approach allows businesses to concentrate on expansion and progress instead of having concerns about a lack of cash flow.

For putting into effect ACH payment handling, companies must initially pick an ACH payment handler. This can be a bank or another party service giver that makes electronic transactions possible. After the choice of processor is made, businesses have to establish a merchant account and supply required papers like banking details and business information. Usually, the process of setting up involves confirming the company's identity and determining transaction limits. When the account is activated, companies can start processing ACH payments by forwarding payment instructions to the ACH network. It becomes very important to keep correct records of transactions and ensure alignment with NACHA regulations to avoid any penalties or interruptions in service.

Businesses must think about mixing their ACH processing with current financial software systems. Doing this mix can make operational efficiency better a lot by making tasks like creating invoices and tracking payments automatically. Also, businesses can put in notices and alerts for when ACH transactions are coming in or going out; helping shareholders stay aware of money movements. These active steps can assist companies to manage their cash flow more effectively and keep control of their financial situation.

While ACH payment handling gives many advantages, companies could encounter problems during the introduction. One usual worry is about possible chargebacks or disagreements over transactions. Contrary to credit card payments, ACH deals do not carry a similar degree of protection for consumers which sometimes causes issues when customers contest charges. To reduce this danger, companies need to put in place definite policies for refunds and cancellations and keep good correspondence with their customers. Furthermore, making certain that everyone included in the transaction comprehends the method and their obligations can aid in avoiding confusion. Frequent surveillance of transaction proceedings may also help reveal any out-of-the-ordinary trends indicating deception or mistakes.

To lessen risks connected with ACH transactions, companies can spend money on strong systems for detecting and preventing fraud. These systems can study the patterns of transactions as they occur and note any activity that seems unusual. This lets organizations act straight away. Teaching employees about the best ways to manage ACH transactions is another key part of lowering mistakes and enhancing safety in all dealings. Setting up a culture of watchfulness within the company is beneficial because it makes sure everyone knows about the dangers and what steps to take for protection.

The digital payment solution environment is always changing, and ACH payment processing plays a key part in this change. New techniques like artificial intelligence (AI) and blockchain are more and more included in the systems of payments to make them safer and quicker. Businesses want to give better experiences for their customers, so they will likely need smooth payment solutions even more. This tendency is expected to stimulate more advances in ACH processing, like quicker transaction periods and superior elements such as immediate payment alerts. Enterprises that adjust to these alterations will be more effectively prepared to meet customer anticipations and competitive advantage.

Besides AI and blockchain, the growth of mobile payment solutions is also shaping the future of ACH processing. More customers are now using their mobile devices for transactions. This makes it necessary for businesses to make sure their ACH solutions can work with these platforms. Moreover, as e-commerce keeps growing, there's a higher need for efficient ways to pay. Processing with ACH provides a method for meeting this need while keeping costs low and security high. It's very important for companies who want to use ACH payments well, to keep up-to-date about these developments.

To sum up, using ACH payment processing to make the payment process digital is a good chance for businesses to simplify their financial transactions. By getting knowledge about the complex details of the ACH network, applying successful payment solutions and tackling possible problems, companies can greatly better their work efficiency. As changes continue in the digital payments landscape, accepting ACH payments will become necessary for businesses that to want succeed in a competitive setting. When you put your money into automated clearing house systems, it helps the finances and also improves the happiness of customers because they get a fast and trustable way for payments.

Advertisement

By Martina Wlison/Nov 05, 2024

By Verna Wesley/Feb 28, 2025

By Martina Wlison/Nov 08, 2024

By Kristina Cappetta/Mar 18, 2025

By Celia Shatzman/Jan 01, 2024

By Aldrich Acheson/Feb 28, 2025

By Tessa Rodriguez/Dec 10, 2024

By Celia Shatzman/Dec 04, 2024

By Christin Shatzman/Dec 08, 2024

By Sean William/Dec 09, 2024

By Isabella Moss/Nov 09, 2024

By Verna Wesley/Dec 23, 2024