The Barclaycard Arrival Plus is made for those who travel and want a rewards credit card that gives substantial worth without making the earning process complex. This card comes with an appealing reward scheme where you gain points on each buy, which can be used against your traveling costs later. We will overview this card's features, advantages, and downsides in this article, as well as provide insights into whether it fits your traveling requirements.

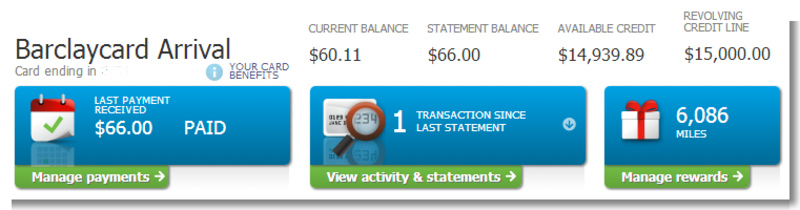

One attractive aspect of the Barclaycard Arrival Plus is its simple rewards scheme. For every dollar spent on purchases, cardholders obtain two miles, which allows for easy point gathering without having to deal with changing categories or spending caps. Furthermore, new card owners usually receive a considerable welcome bonus if they meet a certain spending amount within the initial months. This initial bonus can significantly boost your rewards balance and enhance your travel experiences.

An attractive feature of this card is the absence of foreign transaction fees. Several travelers face extra expenses when they make purchases in another country because other credit cards impose foreign transaction costs. However, with Barclaycard Arrival Plus, users can utilize their cards globally without concern about these additional charges - a perfect option for regular flyers or international tourists. This characteristic improves its attractiveness because it permits users to optimize their expenditure during travel.

Using the Barclaycard Arrival Plus to get rewards is a process that's easy for users. People who have this card can use their gathered miles to pay different travel costs, such as flights, staying in hotels, renting cars, and other things. The card lets people book trips through any service provider they prefer and then use their miles as a credit on those buys on their statement. This adaptability gives card users the liberty to select travel choices that are most fitting for their requirements without being to certain reservation platforms.

However, it's crucial to understand that the miles you earn with Barclaycard Arrival Plus are seen as travel credits, not usual points. So, people need to manage their redemptions thoughtfully to make sure they obtain maximum value from these miles. On top of this, users can also see detailed instructions about redemption quantities and acceptable expenses on the website Barclay card. This guarantees clearness in how rewards may be used.

Usually, the Barclaycard Arrival Plus has a yearly charge which is not required in its first year. This permits users to assess the card's advantages without any risk involved. Once one year passes, those who possess the card should consider whether or not they gain enough from rewards for it to be worth paying this annual cost and if keeping it still makes sense financially.

When you think about interest rates, people who want to use the card should reflect on how much they usually spend and if they can clear their debts each month. The APR of Barclaycard Arrival Plus might be different depending on your credit rating. So, some users may deal with higher interest rates if they have a balance left over. It's wise for those holding cards to clear all their dues every month so that no extra charges are incurred and also get maximum benefits from their rewards.

When you look at Barclaycard Arrival Plus and other credit cards for travel rewards, people who want to use them should think about things like how the rewards are structured, costs, and ways to redeem them. A lot of cards have good reward systems but it might be easier for some users if they get two miles per dollar spent with Barclaycard instead of dealing with complicated reward schemes in other credit cards.

Some travel credit cards can offer a higher earning rate in certain areas, like eating out or booking accommodations. However, they also usually include extra charges for purchases made abroad which is not the case with Barclaycard Arrival Plus card. Therefore, it's good if users check their traveling behavior spending habits before deciding if either this card or another one suits their financial goals better.

The Barclaycard Arrival Plus is a good choice for people who travel and want to earn rewards without dealing with complex redemption procedures or extra charges on foreign transactions. Its simple way of gaining points, as well as the freedom in using these miles, makes it appealing to different types of users. It's important though to note the yearly fee and interest rates especially if you're unable to settle your account balance monthly but overall, this card brings considerable benefits for frequent travelers. Generally, the Barclaycard Arrival Plus could be a good option to think about for people who are looking for a travel rewards credit card that matches their spending patterns and travel objectives.

By Sid Leonard/Apr 02, 2025

By Susan Kelly/Feb 28, 2025

By Sean William/Dec 09, 2024

By Isabella Moss/Nov 07, 2024

By Gabrielle Bennett /Mar 16, 2025

By Darnell Malan/Feb 28, 2025

By Elva Flynn/Feb 28, 2025

By Celia Shatzman/Nov 05, 2024

By Martina Wlison/Nov 05, 2024

By Martina Wlison/Nov 08, 2024

By Verna Wesley/Feb 28, 2025

By Aldrich Acheson/Feb 28, 2025