The journey through the terrain of student loans is often tough, especially when it comes to handling repayments. Plenty of borrowers encounter trouble in meeting their monthly installments because of different issues like income alterations, job termination or just carrying a huge debt load. This article will delve into a few methods that can assist in reducing effectively student loan installments. Comprehending these choices can offer comfort and enable loan takers to make knowledgeable choices about their finances ahead.

Reducing monthly student loan payments is possible through income-driven repayment (IDR) plans. This system modifies your regular payment considering your earnings and the number of people in the family, hence you only pay what's within means for you. There are many IDR plans one can choose from like Revised Pay As You Earn (REPAYE), Pay As You Earn (PAYE), or Income-Based Repayment (IBR). Each scheme has its distinct qualifications and conditions. Usually, your dues are limited to a fraction of your discretionary earnings, with the potential for any leftover amount to be pardoned after certain years based on the plan you select. This can considerably lessen monetary stress for individuals dealing with reduced incomes or shifting financial scenarios.

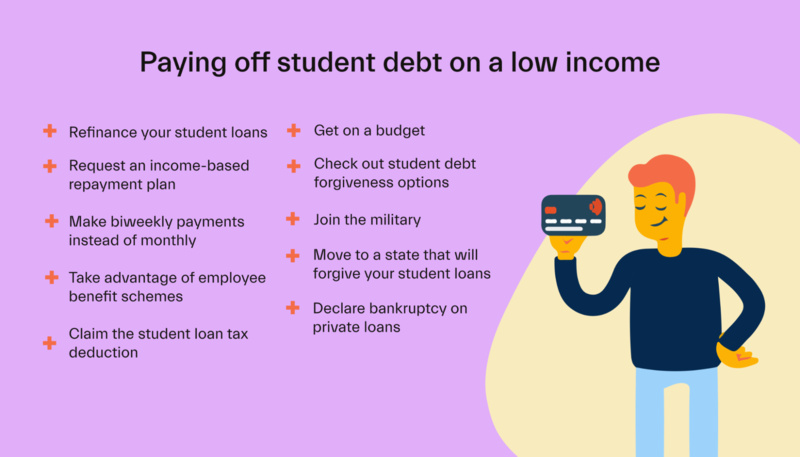

People who work in public service jobs or specific professions may find student loan forgiveness programs very beneficial for their financial situation. The well-known Public Service Loan.m Forgiveness (PSLF) program is a great choice for those individuals who are employed by government groups or non-profit organizations. To be eligible, they must make 120 approved monthly payments following an accepted repayment plan while being employed with an approved employer. Other pardon programs, for instance, Teacher Loan Forgiveness or the Federal Perkins Loan Cancellation might also apply to certain professions. Comprehending the requirements and advantages of these initiatives could assist individuals in decreasing their complete student loan debt and payments, at last resulting in monetary independence.

Another plan to decrease monthly payments can be refinancing student loans. By getting a new loan for settling exist. With student loans, borrowers have the chance to use lower interest rates or longer repayment periods. This method results in reduced monthly amounts and total savings overall. But, you should. Remember that converting federal student loans to private ones can stop you from getting some benefits like IDR schemes and options for forgiving loans. So, people borrowing money need to think carefully about the good and bad points of refinancing by looking at their current financial status and the goals they want to reach in the future before going forward with it.

When people face money problems, they might need to find short-term solutions to reduce their student loan payments. A lot of services for federal student loans provide options like deferment or forbearance which let borrowers stop their payments temporarily without any fines. During the period of deferment, certain kinds of loans may not increase interest while in forbearance loans usually keep gathering interest. These choices might give immediate comfort, but they are not long-lasting solutions and should be carefully utilized. Loan takers must examine their financial situations and consider these alternatives only when required to prevent escalating their debt in the future.

Budgeting well and planning the finances are very important in managing payments of student loans. If borrowers make a thorough budget that considers all income and expenses, they can see where costs could be reduced to put more money toward their student loans. This strategy not only assists with handling monthly payments but also encourages good financial health overall. Furthermore, it is important for borrowers to consistently examine their financial objectives and modify their spending plans in alignment with these goals to maintain the right course. Using monetary planning instruments or seeking advice from a finance consultant can also offer a crucial understanding of managing student loans and attaining long-term economic security.

In the end, it is very important for people who borrow to fully comprehend all the rules and regulations of their student loans. This implies being aware of rates of interest, terms concerning repayment, as well as any possible charges. If borrowers are knowledgeable regarding these details, they can make wise choices related to payments or options for refinancing if available. Also, it is crucial to keep in touch with loan services because they can offer details about various repayment choices and help programs. If borrowers are proactive and knowledgeable about their loans, this could be a significant step towards reducing their student loan payments as well as gaining financial freedom.

To sum up, handling student loan payments effectively needs a multiple-sided technique. Looking into repayment plans based on income, using options for loan forgiveness, thinking about refinancing, and seeking temporary help are all strategies to consider. Budgeting smartly and comprehending the terms of the loan can aid borrowers in lowering their monthly payments considerably while they strive for financial independence. Every choice provides distinct advantages; understanding how these can fit into one's monetary plan is crucial for successful debt control.

By Celia Shatzman/Nov 05, 2024

By Triston Martin/Dec 03, 2024

By Gabrielle Bennett /Dec 10, 2024

By Martina Wlison/Nov 08, 2024

By Jennifer Redmond/Apr 01, 2025

By Christin Shatzman/Dec 08, 2024

By Susan Kelly/Feb 28, 2025

By Sean William/Dec 09, 2024

By Elva Flynn/Feb 28, 2025

By Aldrich Acheson/Feb 28, 2025

By Noa Ensign/Nov 07, 2024

By Celia Shatzman/Dec 04, 2024