Advertisement

Inflation touches all people because the price of life goes up, which influences how much your savings can buy. When costs go higher, it is crucial to look for methods that keep your savings safe and make sure you still reach your financial aims. This article will talk about different useful ways to strengthen your savings against inflation so keeping steady financially even in tough money periods becomes possible.

Inflation is the speed at which prices for goods and services increase, causing purchasing power .as to get smaller. This situation can greatly impact one's financial state because, over time, you'll be able to purchase less with the same amount of money. What causes inflation? It m. oaay come about from production costs going up, more demand than what supply can meet, or even shifts in government policies. Knowing how inflation affects your savings is an initial m.sm ove in creating plans to guard your financial resources. Maintaining a balance of your savings against inflation lets you secure the capacity to fulfill future costs and monetary obligations.

To fight inflation, a good method is to put money in savings accounts with high interest. Savings accounts that are traditional many times give low interest rates and may not compete with inflation. This can cause your funds to decrease in value as time goes by. On the contrary, usually, savings accounts of high interest provide superior interest rates which help your reserves increase at a speed able to balance out inflation. When you choose a high-interest savings account, think about things like charges, withdrawal restrictions, and the bank's good name. Also, make sure that the interest rate given is on par with current rates of inflation because it will assist your savings to keep their buying strength.

Certificates of Deposit, also known as CDs, can be useful for shielding your savings from inflation. Banks and credit unions provide these time deposits which often give higher interest rates compared to regular savings accounts because you agree to keep your money in there for a certain period. It could be a few months or even multiple years. If you select long-duration CDs when interest rates are good, it can provide more return from your savings. Yet, important to think about the chance of increasing interest rates later and how this might affect your investment. When the CD reaches a maturity date, options could be reassessed and new investments in another CD or different financial product that suits needs better is possible.

Another way to keep your savings safe is by putting money in securities that are protected against inflation. These bonds issued by the government, like Treasury Inflation-Protected Securities (TIPS) found in America, are made to shield investors from rising costs. TIPS offers returns that adjust with increasing living costs, making sure your investment keeps its buying power as time goes on. The main worth of TIPS goes up with inflation and drops when there is deflation. Interest payments occur twice in a year, calculated by the modified principal that gives steady income which increases if there's inflation. Putting money into these securities might be an efficient method to make sure your savings stay safe from the damaging impact of higher rates.

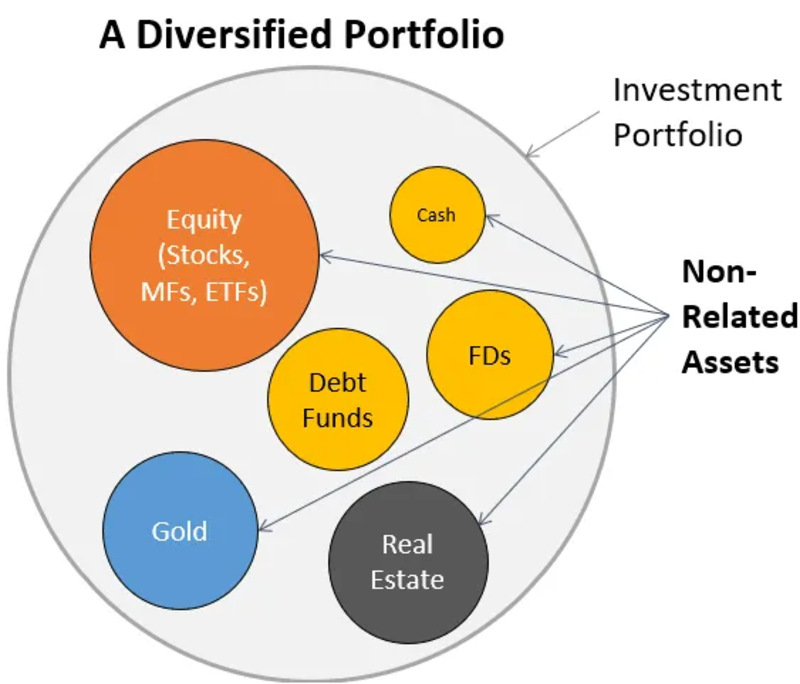

To protect your money further from inflation, you should think about spreading out your investment. This technique means distributing your investments among different types of assets, like shares in companies, bonds and securities, property market, or physical commodities as examples. Taking this route can help soften the impact of risks tied to an individual investment which makes it less stressful to manage overall financial stability during times when prices increase broadly. In the past, shares have usually beaten inflation over a lengthy period. This makes them an important part of a varied investment portfolio. Investments in real estate can also act as protection against inflation since property values and rental income generally increase with rising prices. By keeping your investments diverse, you boost the likelihood of maintaining your savings' buying power.

Eventually, it is very important to check and modify your financial plan frequently so that your savings are safe from inflation. Your method of saving and investing should change according to shifts in economic situations. You must evaluate your monetary goals, ways of saving money, and growth in investments at least annually to decide if changes are required. Be very observant of the fluctuations in inflation rates, interest rates, and how your investments are doing. By being aware and active, you can make needed changes to your financial plan which will enable you to achieve what you aim for while keeping up with your buying power despite increased prices.

Finally, it is very important to safeguard your savings from inflation to secure your financial health. By knowing the effects of inflation, looking at high-interest saving accounts, checking CDs out, putting money in securities protected against inflation, and varying where you invest, these methods will protect your savings well. Using these tactics can help you handle the difficulties of inflation and keep the stability of finances for the coming time.

Advertisement

By Sean William/Dec 09, 2024

By Celia Kreitner/Dec 08, 2024

By Christin Shatzman/Dec 08, 2024

By Georgia Vincent/Dec 15, 2024

By Mason Garvey/Dec 10, 2024

By Kristina Cappetta/Mar 18, 2025

By Martina Wlison/Nov 05, 2024

By Celia Shatzman/Jan 18, 2025

By Gabrielle Bennett /Mar 16, 2025

By Jennifer Redmond/Apr 01, 2025

By Aldrich Acheson/Feb 28, 2025

By Celia Shatzman/Jan 01, 2024